- #Budget - Year 2022

- #Budget - Year 2021

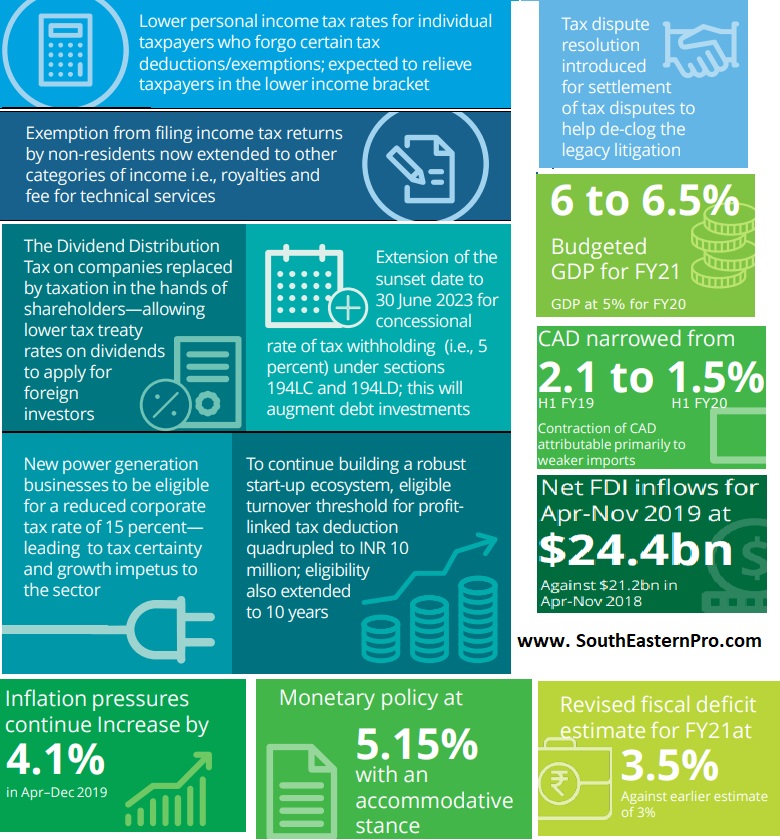

- #Budget - Year 2020

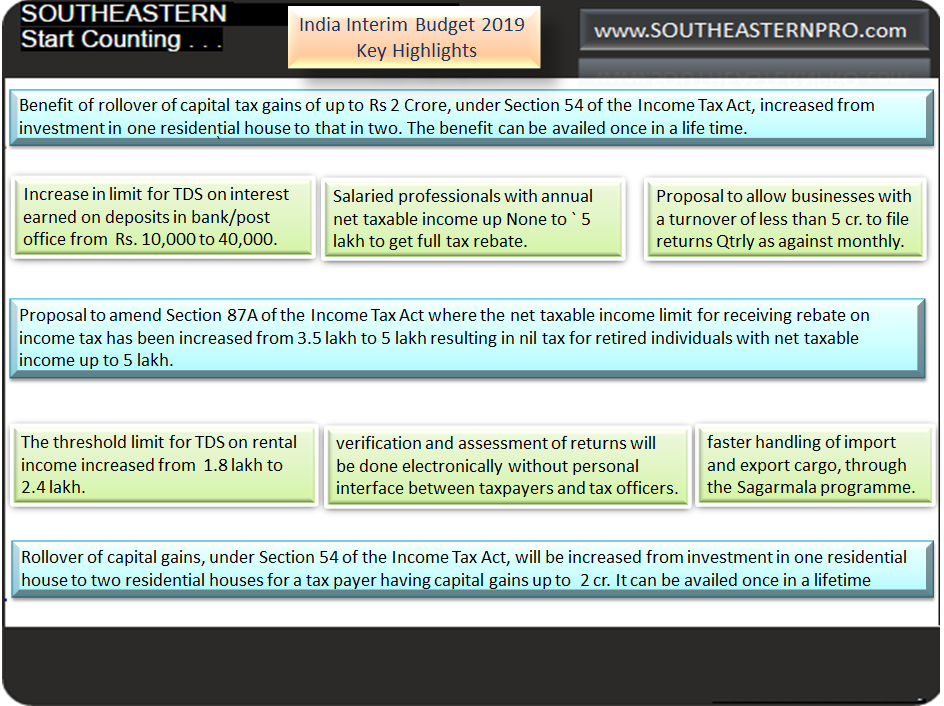

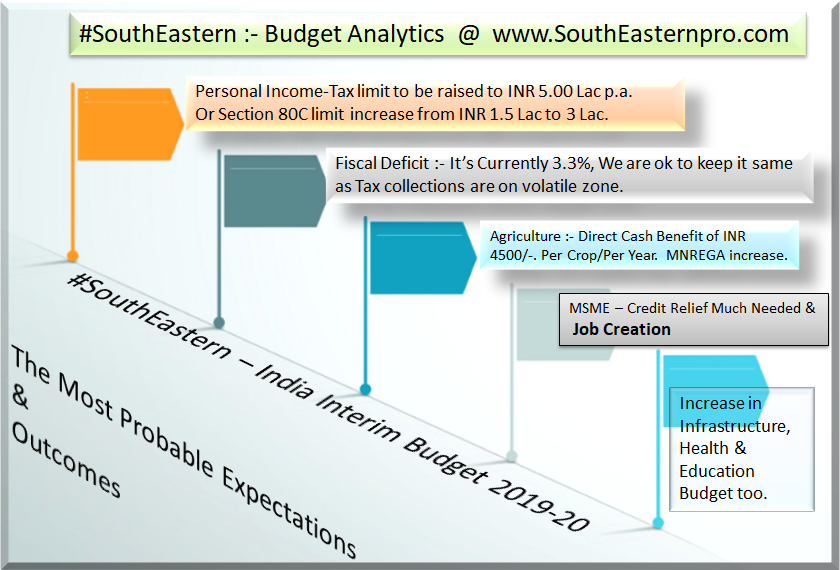

- #Budget - Year 2019

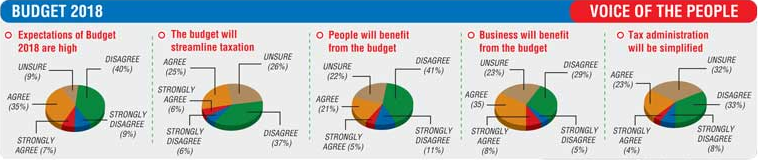

- #Budget - Year 2018

- #Budget - Year 2017

- #Budget - Year 2016

- #BSE-Matrix

This year too we expect both reformist and pro-growth budget. It is expected that government would announce some of the allocation of funds that can genuinely be absorbed for capital expenditure and infrastructure spending, to help fuel the investment cycle, creating jobs and improve domestic demand, while at the same time rationalizing Centrally-sponsored schemes and Central sector schemes to further improve the quality as well as efficiency of the expenditure.

In the last couple of years the government has been emphasizing on building robust infrastructure. The National Infrastructure Pipeline (NIP) envisaged an infrastructure investment of Rs. 111 lakh crore over a period of five year starting 2020. In the last budget the Finance Minister upheld the investment planned in NIP and a three-pronged strategy was laid out, Firstly, creating institutional structure, secondly, asset monetization, and thirdly enhancing share of capital expenditure in the center and state budget, to complete the ambitious target. Apart from core infrastructure sectors such as roads, highways and railways, logistics can be a key focus area to ease transportation costs and reduce the elevated logistics across the country. In this regard, the Government has reportedly proposed a new warehousing policy in Dec 2021 that will set the roadmap for development of exclusive warehousing zones in public-private partnership mode. Hence, it is expected that the budget allocation for the railways is set to hit a record level next fiscal as the government gears up to support a major makeover for the national transporter. Besides, there is a possibility of excise duty reduction on petroleum products.

The market is also looking for support measures for sectors such as housing, autos, and auto ancillaries, PLI-related measures in multiple sectors. The government may announce asset monetization of public sector undertakings under National Monetization Pipeline (NMP). It can also monetise the housing and commercial real estate it owns by floating REITs. The disinvestment plan is likely to become clearer with the Budget.

The government is trying to narrow the gap via its disinvestment plan. So far, the government has been able to raise Rs 9,330 crore through selling its stakes in PSUs. But the LIC IPO, which is expected to hit the market in March end 2022, and may help the government in a big way by raising over Rs 1 lakh crore. The total disinvestment target of the government is Rs 1.75 lakh crore for the current fiscal. The pending big ticket divestment apart from IPO of LIC, include IDBI Bank, Bharat Petroleum Corporation, Pawan Hans, Shipping Corporation of India, BEML, Container Corporation of India, among others.

Real estate is one of the key pillars of the Indian economy contributing around ~ 8% to the overall GDP. The sector has witnessed a strong comeback last year as housing sales in top cities jumped to 90% of the pre-covid levels while newly launched units reached the 2019 levels. The general expectation is that this budget will incentivize both the rental housing market and the affordable housing sector. The sector has huge expectations from the upcoming Budget such as demands of industry status and easy availability of finance. A single window clearance mechanism has remained a demand for many years now.

Globally, the price of fertilizers surged significantly adversely affecting India which depends on import , the price of Urea, which is most commonly used, tripled to $990/tonne while the DAP price doubled to $700-800 per ton as compared to prices that existed one and half year ago. Besides, the recent spurt in natural gas, which accounts for 80% cost of urea production, is expected to continue to raise the production cost of Urea. Currently, the farmers are facing shortage of fertilizer and the agriculture department has urgent intervention of the center to ensure adequate supply of fertilizer. The farmers are already in distress due to the second wave of the pandemic which hit hard on the rural India, higher price and shortage of fertilizer would further impact the financial position. Government is thus expected to focus on improving the farmers’ earnings through enhanced support for the agricultural economy. This will benefit the entire ecosystem of agri-inputs, i.e seed, fertilizer, crop protection and chemical and tractors etc. In the last few budgets the government has raised the budgetary allocation towards the fertilizer subsidy and in the forthcoming budget, we expect fertilizer subsidy of Rs. 1.3 lakh crore. Besides, the government may also raise the farm credit to 18 lakh crore up from 16.5 lakh crore for the current year, continuing with the same policy adopted earlier, to support the farmer to recover from the pandemic.

ECLGS (Emergency Credit Linked Guarantee Scheme) was introduced by the government in March 2020 to provide financial support to the pandemic hit MSME sector and later extended to other stressed industries along enhancing the credit limit from Rs. 3 lakh crore to Rs.4.5 lakh crore. The scheme is extended till March 2022. The pandemic has severely affected them and the stress in the sector is still very high and many of the eligible MSME are under various stages of restructuring. We expect government to further extend the scheme till March 2023 or till such time the economy regains strength, this would enable the banks to continue the liquidity support.

In an environment of high inflation due to higher input cost and high unemployment caused due to pandemic the government is expected to provide relief to individuals and increase disposable income to boost consumption. Government may increase the limits on standard deduction from Rs.50,000 to Rs. 100,000. Expect increase in the tax benefit on home loan interest and principal repayment by Rs. 50,000 each, higher from the current level of Rs. 200,000 and Rs. 150,000 respectively. Government may provide interest subsidy of 3-4% on home loan for 3 years.

Banking Sector :- State Bank of India I ICICI Bank I Canara Bank I Bank of Baroda

Capital Goods :- Larsen Toubro I Siemens I Bharat Electronics I Finolex Cables

Real Estate :- DLF I Oberoi Reality I Prestige Estate

FMCG :- ITC I Dabur India

Healthcare :- Sun Pharmaceuticals I Gland Pharma

Automobiles :- Bajaj Auto I M&M I Endurance Technologies

Power :- Tata Power I BEL I Power Grid Corporation

Consumer Durables :- Crompton Graves I Tata Consumer

Construction :- PNC Infratech I Action Construction I Ahluwalia Contract

She added, “Corporate surcharge to be reduced from 12% to 7%. I propose to provide that any income from transfer of any virtual digital asset shall be taxed at the rate of 30%. No deduction in respect of any expenditure or allowance shall be allowed while computing such income, except cost of acquisition.

No tax returns for Senior Citizens, age 75 years and above who have pension and interest income

Income Tax returns will have prefilled data from capital gains etc. To ease compliance for taxpayers, details of salary income, tax payment and TDS are prefilled currently

Faceless Income tax Appellate Tribunals National faceless ITAT centre to be set up

Reduce time limit for reopening of tax assessments to 3 years. Reduction in Time for Income Tax Proceedings – Presently an assessment can be opened in 6 years, and in serious tax fraud cases for up to 10 years. FM proposes to revise this limit for reopening of assessments to 3 years from the present 6 years

Tax Audit threshold of turnover further increased for digital transactions to 10 crores

Dispute Resolution Panel for small taxpayers

Advance tax on dividend to accrue only after it is declared.

Affordable housing is a priority area Rs1.5 lakh for loans to purchase affordable house is now extended by one more year

To further extend efforts towards unorganised labour force, I propose to launch a portal to collect relevant information on workers, building/construction workers among others

To enable deduction of tax on dividend income at lower treaty rates for FPIs

India FY21 budget deficit is said to be 9.5% of GDP. FY’21 fiscal deficit (Revised Estimate) pegged at 9.5% of GDP; fiscal deficit seen at 6.8% for FY22

India is said to estimate FY22 expenditure at about Rs 35 lakh crore.

11,000 kms of national Highway to be Completed

Divestment target for FY22 at Rs 1.75 lakh cr. Asking Niti Aayog to work on the next list of PSU cos that could be taken up for divestment. Other than IDBI Bank, two other PSBs and one general insurance company to be divested in FY22

Introduce Investor Charter as a right of all investors across financial instruments.

100% Electrification of Rail Routes by DEC 2023.

Decriminalisation under LLP Act Small Company definition changed, One Person Company revamped will be Big Boost to Startups

NRIs to be allowed to set up One Person Companies

The total estimate of all relief measures announced by govt & RBI so far is Rs 27.1 lakh cr (13% of GDP) in Covd19

Forthcoming census will be a digital census, allocating Rs 3768 crores for the exercise

The National Statistical Office has projected a 7.7% contraction in GDP in 2020-21.

Through the past year, the Finance Minister announced a Rs 30-lakh-crore plan, in ‘mini-budgets’ to beat Covid

Aim to double farmers income. The total financial impact of all AatmaNirbhar packages including measures taken by RBI was estimated to be about Rs 27.1 lakh crores

A portion of the agricultural fund will be allocated to APMC for furthering their infrastructure

New scheme called PM Aatmanirbhar Swastha Bharat to be launched, outlay of `64,180cr over 6 yrs

Announcing a voluntary scrapping policy to phase out polluting vehicles. Vehicles to undergo fitness tests after 20 years for personal vehicles and 15 years for CVs

Jal Jeevan Mission Urban to be launched at outlay of Rs 2.87 lakh crore.

17,000 rural and 11,000 urban health and wellness centres to be set up.

India has two COVID-19 vaccines available and we expect two more vaccines soon

A vision for Atmanirbhar Bharat in part of Sitharaman’s first part.

FY22 budget proposals based on six pillars namely Health & Well-being, Inclusive Development Human Capital, Innovation and R&D, Physical & Financial capital and infrastructure, Minimum government, maximum governance

FY22 outlay (budget estimate) for health & well-being up 138%, is Rs 2,23,846 cr.

Scheme of mega invt textile park will be launched in addition to PLI scheme, 7 textiles parks to be unveiled over 3 years. Rs5 lakh cr will be lent by DFI in 3 years time

Professionally managed development financial institution (DFI) will be introduced with an allocation of 20,000cr

Asset monetisation dashboard will be created to provide clarity to investor Monetization of gas pipeline of GAIL, HPCL planned

A scheme of Mega Investments Textile Park will be launched in addition to PLI Scheme which will create world class infrastructure with plug & play facilities to enable global champions in exports

To tackle the problem of air pollution, propose, Rs 2200 crore for 42 urban centres; also announcing a vehicle scrapping policy towards reducing vehicular pollution

Rs. 2.86 Cr. Household tap connection to be established.

For 2021-22; capital expenditure seen at Rs 5.54 lakh cr, +34.5% increase YOY

3500 km of national highway work being planned in Tamil Nadu at an investment of Rs 1.3 lakh cr

FY21 capital expenditure seen at Rs 4.39 lakh crore

Rs 44,000 crore under capital expenditure to be given to Department of Economic Affairs in FY22

Over and above this, Rs 2 lakh crore will be provided to states and autonomous bodies to nudge their expenditure.

Rs 1.03 lakh for highway project for Tamil Nadu

FY 22 allocation for Railways at Rs 1,10,055cr

Highway works proposed: 3500kms corridor in TN 1,100km in Kerala at investment of Rs 65,000 cr 675km in West Bengal at cost of Rs 95,000 cr 1300 kms in Assam in coming 3 years

Over 13,000 km length of roads at a cost of Rs 3.3 lakh cr has already been awarded under Rs 5.35 lakh cr Bharatmala project of which 3,800 kms have been constructed

Main interventions under PM Aatmanirbhar Swasth BharatYojana include Support for Health and Wellness Centres, Setting up Integrated Public Health labs in all districts, Critical care hospital blocks, Strengthening of NCDC

National Monetisation Pipeline of potential brownfield infra projects to be launched. Details a few road and power assets to be transferred to NHAI, PGCIL InvITs.

Scheme to assist Discoms will be launched with an outlay of over Rs 3 lakh cr

Railway to monetise dedicated freight corridors,

Four Acts converged into Securities Market Code, Investor Charter Introduced to Protect Investors, Insurance Act Amended to introduce FDI and AMC to be set up to take over stressed debts of Banks

Propose to amend the Insurance Act, propose to hike FDI limit to 74 percent from 49 percent. Also to allow foreign ownership & control with safeguards

Proposes to consolidate provisions of SEBI Act, Depositories Act, Securities Contracts Regulation Act, Government Securities Act

Decriminalisation under LLP Act Small Company definition changed, One Person Company revamped will be Big Boost to Startups

Proposes to change the definition of a small company under the Companies Act 2013 by increasing their threshold for paid-up capital, from not exceeding Rs 50 lakhs, to not exceeding Rs 2 crores and Turnover from not exceeding Rs 2 crores to not exceeding 20 crores

Scheme for promoting flagging of merchant ships in India will be launched by providing subsidy support

Privatisation of one General Insurance PSU and IPO of LIC proposed

PM Swastha Bharat Yojana with an outlay of over Rs64000 cr

Govt to announce a policy for the privatisation of state-run cos & to create new list of companies for Divestment

Ujjwala Scheme to Cover 1 Crore more Beneficiaries

100 more Dist. to be added under city Gas Expansion

In case of wheat, the amount paid to farmers in 2019-2020 was ₹62,802 crore and in 2020-2021 it was further increased to ₹75,060 crore

To provide Rs 20,000 crore in FY22 for recapitalisation of public sector banks.

1.54 crore farmers benefited from MSP in paddy and what in FY21 vs 1.24 crore YoY

Asset reconstruction and management company to be set up for stressed assets of banks:

Ujjwala scheme will be expanded to over 1 crore more beneficiaries. We will add 100 more districts in the next three years to the city gas distribution network. A gas pipeline project will be taken up in Jammu and Kashmir

The MSP regime has undergone a change to assure price that is at least 1.5 times the cost of production across all commodities:

National Infrastructure Pipeline was launched with 6835 projects

Propose PSU Bank RECAP worth Rs. 20,000 Cr. FY 22.

Government sets agriculture credit target of Rs 16.5 lakh crore for FY22.

One-nation, one-ration plan under implementation by 32 states and union territories

Five major fishing harbours to be developed as hubs for economic activity

Micro irrigation corpus doubled to Rs 10,000 cr. Agriculture infra fund will be made available to APMCs

100 new sainik schools will be set up in partnership with NGOs. There are other ‘umbrella’ structures to be created for higher education

For further setting up of Higher Education in Ladakh under NEP 2020, I propose to set up a central university in place

Provided Rs. 15,700 crore to MSME sector. MSME allocation to be doubled. Government to set aside Rs 15,700 crore in FY22. Government also proposes to reduce margin money requirement from 25% to 15% for startups.

Propose Rs 40000 Crore outlay for FY22 Rural Infra Fund

After achieving target of 8 crore LPG connections, Pradhan Mantri Ujjwala Yojana to cover another additional 1 crore beneficiaries.

Green scheme to be expanded to 22 perishable vegetable products

More than 15,000 schools in the country will be qualitatively strengthened to include all components of the National Education Policy:

On the recommendations of the 15th Finance Commission, a detailed exercise has been undertaken to rationalize and bring down the number of Centrally Sponsored Schemes. This will enable consolidation of outlays, for better impact

Enhanced outlay of ₹ 1,18,101 crore for Roads

1,000 more mandis will be integrated with electronic national market

A scheme for tea farmers will be introduced for the welfare of women and Children in Assam

Proposing substantial investments in the development of modern fishing harbours & fish landing centres. 5 major fishing harbours – Kochi, Chennai, Visakhapatnam, Paradip and Petuaghat will be developed as hubs for economic activities:

Record sum of ₹ 1,10,055 crore to be provided for Indian Railways, out of which ₹ 1,07,100 is for capital expenditure only

New scheme at a cost of ₹ 18,000 crore for augmentation of public bus transport services

Will facilitate deployment of innovative PPP models enabling private players to finance, acquire, operate and maintain over 20,000 buses

Y’22 Gross borrowing target at Rs 12 lakh crore; Need another Rs 80,000cr in next 2 months, will approach market to raise it

Govt proposes portal to collect info on gig-workers, building and construction workers, among others

Govt proposes to amend apprenticeship law to enhance opportunities for youth

Contingency Fund of India corpus to be raised to Rs 30,000 crore.

Normal ceiling for net borrowing for states at 4% of GSDP as per Finance Commission recommendations

Rs 1,500 cr earmarked for scheme to incentivise digital payments:

FM says government committed to bringing down fiscal deficit below 4.5 pc of GDP by 2025-26

Big boost for startups. Incorporation of one person companies to incentivize innovation in startups. Reducing residency limit for Indian citizen to set up 1 person company from 182 to 120 days

Govt proposes national language translation initiative

States to get 41 pc share of taxes as per 15th Finance Commission recommendation; govt has accepted the recommendation

proposes to review 400 old exemptions in Customs duties in FY22

Pre Budget Day :-

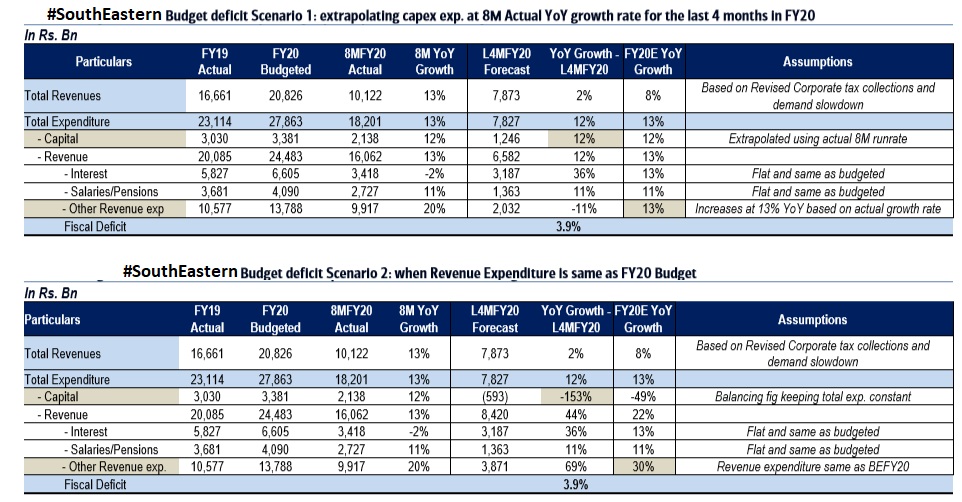

Explore the best Live analytics of Indian Economy & its Budget with #SouthEastern. Every #Budget roam around the Fiscal Mathematics; which basically shows the difference of Total Revenue & Total Expenditure. We are sharing the two Budget Deficit Scenarios that will give you an Idea about Deficit target for our Finance Minister.

#SouthEastern Live Budget analysis has started with Govt issue its Economic Survey & President budget speech now, we will float update on real time as we do for every budget since past 11 years. #Live analytics update on #WhatsApp, #SE WebSite Budget Page, #SE Tweet Handle & #SE LinkedIn Prime Group.. Stay tuned with #SE Advance Analytics... !!

Note :- A detail analysis has been done for this year budget based on it we have Identified two sector funds which has big potential to perform well in a short duration time of 3 Years. In the Year 2016 we had analyzed two sector funds where it made money double in just 3 years of time. Happy Investing.. !!

Good Morning - Indian Budget Day

12:50 pm :- Budget 2019 Income Tax Slab Rates Changes Expectations: Individuals with a gross income of Rs 6.5 lakh will have to pay no tax if they make an investment. FM also said standard deduction would be raised from Rs 40,000 to Rs 50,000.

12:30 Big Update - Individual taxpayers with annual income up to 5 lakh rupees to get full tax rebate

11:55 am :- The Government has set the target for Net Borrowing at INR 7.04 Lakh Cr.

11:44 am :- A pension scheme is being launched -'Pradhan Mantri Shram Yogi Bandhan', to provide assured pension of Rs 3000/ month, with contribution of Rs 100/month, for workers in unorganized sector after 60 yrs of age.

11:38 am :- FM : Instead of rescheduling of crop loans, the farmers severely affected by natural calamities will get 2% interest subvention and additional 3% interest subvention upon timely repayment.. #Budget@SouthEastern

11:30 am :- Under Pradhan Mantri Kisan Samman Nidhi, 6000 rupees per year for each farmer, in three installments, to be transferred directly to farmers' bank accounts, for farmers with less than 2 hectares land holding: FM

#SouthEastern was looking for ₹4k per crop/per year...

11:13 am :- A number of measures were brought in to ensure clean banking: FM

11:10 am :- The next-gen reforms in last five years have set the stage for decades of high growth: - Piyush Goyal

11:15 am :- हमने कमरतोड़ महंगाई की कमर ही तोड़ दी, हम दुनिया की छठी सबसे बड़ी अर्थव्यवस्था है - Piyush Goyal

10:55 am :- #SouthEastern Cautious approach :- Foreign investors are raising questions on data revision. Shocked about statistical revisions in India.

10:03 :- The Big analysis where #SouthEastern focusing on are;

- Where does the money come from?

- How is the money spent?

10:01 am :- Its Profit booking time on all three budget picks, on an average 1 derivative lot trade, all the three stocks making big profit of Rs. 20,000+. (CMP, BhartiAirtel@319, HUL@1791 & ITC @281), Keep our M3 Charts indicators in place to book big profits throughout the day on our other recommendation's floating on #Privy Client Page. (detail in right side Tweeter link where Print screen updated #Live)

9:18 am We have given 3 Budget Special Intraday Stock Trades, Bharti Airtel@310.90, HUL@1773 & ITC @279.30.

INDIAN BUDGET 1st February 2018

The Year 2018-19 budget faced unique pressures and constraints. India has participated in the global equity market rally but not fully in the global growth momentum - the rating upgrade by Moody’s had put the credibility pressure on the stated fiscal consolidation path. Further, with the advent of GST, government may not be able to change vast majority of indirect taxes. And finally, oil at US$ 70 per barrel and rising bond yields have begun to induce macroeconomic pressures and constrain the fiscal space.

Amidst all the push and pulls, Fiscal slippage in 2017-18 was limited to 30bps and revised deficit estimate is pegged at 3.5% of GDP. The shortfall in indirect tax collection, profits transfer from RBI and telecom related receipts were only partly offset by higher direct taxes and disinvestment receipts. FY19 pencils the deficit at 3.3% of GDP. Overall fiscal arithmetic looks credible and has frayed away from any populist spending. The consolidation is achieved largely through expenditure restraint.

It’s amazing to see the tax-to-GDP is at the highest level while government expenditure to GDP is at a historic low. Total expenditure is budgeted to grow at just 9.1%. However, oil subsidy is unchanged for next year and could be at risk of slippage if crude oil stays high. While the capex spending share through budgetary resources is gradually declining, it is made good by increased capex through PSEs’ resources. A large part of the expenditure side (salaries, pensions, defense, interest payment) is sticky.

Uncertainty on GST (in the light of pending refunds and devolution to states), the assumed tax buoyancy on budgeted taxes appears realistic. Dividend from RBI and PSUs same as last year and telecom revenue at Rs. 487 billion – all appear to be credible. FY18 has seen the highest disinvestment proceeds in the history. Also, it is the first time in last 15 years that the disinvestment targets have been over-achieved. In FY19, the divestment proceeds have been pegged at Rs. 800 billion, which looks achievable. We hope to see beginning of strategic sales, as charted by NITI Aayog, materializing next year.

The budget continued its focus on rural economy and the farm sector- with measures focusing particularly on enhancing productivity. Government intends to ensure that the difference between MSP and market price is compensated to the farmers. The intent to liberalize the export of agriculture and commence an operation green (targeting higher production of key vegetables) bode well for the farm income. Phase III of the Pradhan Mantri Gram Sadak Yojna (PMGSY) will focus on improving the hinterland connectivity. The monetary allocation and targets for the rural housing schemes, though, stands broadly unchanged.

Another big moves in budget was the expansion of social security ambit. This is pertinent to realize our true demographic potential and achieve an inclusive growth. While the monetary outlay on the new grand health insurance scheme in this budget is low, it can be ramped up as the proper eco-system is put in place. MGNREGA, Financial Inclusion, Atal pension scheme, Ujjwala Yojna and now the health insurance – India is constructing a variable of Universal Basic Income for at least its bottom of the pyramid. That said, effective execution will be the key.

On corporate tax rates for small businesses were cut to 25%. Tax relief to senior citizens, salaried employees and small enterprises can likely help in increasing the disposable income. Support to MSME sector can have positive impact on job creation. US has embarked on a sharp tax rate reduction which may be followed by most other economies. India may eventually have to follow suit and lower tax rate for big corporates as well. The thought of having a unique ID for businesses (on the lines of Aadhar which is for individuals) can go a long way in improving the ‘ease of doing business’.

Now 10 year G-sec yield rose by 18 bps to 7.60%, suggesting the likely concern on MSP-hikes pushing inflation expectations higher and possible change in RBI’s stance. Rising global bond yields and crude oil prices are also weighing on the sentiments.

On Rural side the budget opens the door for large MSP revision, the eventual inflationary and fiscal impact will depend on the methodology for measuring the cost of production. A cursory study of the current price setting mechanism suggests that most agri-products are already witnessing an MSP of nearly 1.5x of their production cost.

The fear comes true now as imposition of LTCG tax on equities and increased income tax exemption for senior citizens may attract more funds in the fixed income space. However, one also needs to take cognizance of the increased borrowings through public sector enterprises. Further the expected credit recovery can reduce the banks’ appetite for government bonds. Banks’ holding of G-Sec is already well above the SLR level and foreign investor limit on government securities is nearly used up. However, with increased penetration of insurance and pension sector, one needs to keenly watch their demand for bonds. We believe, investor should build exposure gradually as bond yields are entering in an attractive zone.

Now back to the equity market, the budget finally quelled the long-standing market speculation on long term capital gains tax (LTCG). Budget measures leading to higher disposable income along with farm and rural thrust, consumption growth momentum should continue. The continued focus on the infrastructure (9% increases in monetary allocation) is positive for the related sectors.

The revival in earnings is critical for such rich valuations to sustain. Last few years have favored growth over value stocks. However, recently we have seen interest emerging in contrarian themes such as corporate lenders, IT, telecom and construction. After the stellar performance in 2018, particularly in the mid and small caps segment, it is very important to keep an eye on valuations. With little scope of valuation re-rating, bulk of the returns are likely to be guided by earnings growth.

#SE_Live_Budget 10:01 am :- Finance Minister Arun Jaitley calls on President Kovind at Rashtrapati Bhavan before presenting the Union Budget for the day.. Its Tradition of Indian Budget.

#SE_Live_Budget 8:45 am :- Pre Indian Budget Trend 1st February 2018

Today it's budget day for India, market expected to open on flat note with trend highly volatile during budget speech.

#SouthEastern is keen to analyze budget outcome which will decide our future direction for long term Mutual Fund & Equity Investor.

We have only two big thing to watch out, that will be trend changer;

1 Long term & short term capital gain tax structure, if any change.

2. FISCAL Deficit how Mr. Jaitly will target it, if he expand the govt borrowing or 0.10% of GDP, the amount would cross over $2bn.

Apart from these two top concern;

3. Sector allocation will decide if we can include in MF sector for short term, as we did last year when FM announce over Rs. 3 lac Crore for Infra.

4. How populous this budget will be, Rural & Infra already theme.

5. How well FM can project the budget to make a win for PM Modi in upcoming state & 2019 Election.

There is lot to see today, our budget broadcast will be live on all broadcast ( Tweeter, #SE WebPage, WhatsApp & Privy page with live stock Recommendations)

Have a wonderful Budget day ahead !!

Team #SouthEastern

INDIAN BUDGET 1st February 2017

Live Feed Start from 8 AM on wards, Catch us live on Tweeter, Web & Whatsapp

12:54 pm #SE_Live_Budget personal Income Tax 2.5 to 5 Lac @ 5℅

12:48 pm #SE_Live_Budget Maximum cash donation only Rs 2000 for political parties

12:41 pm #SE_Live_Budget No cash transation above Rs 3 lakh will be allowed

12:33 pm #SE_Live_Budget Fiscal Deficit target for 2017-18 is 3.2%; FRBM roadmap to be followed

12:18 pm #SE_Live_Budget Rs 10,000 cr allocated for recalibration of PSU banks

12:13 pm #SE_Live_Budget Govt doubles lending target to Rs 2.44 lakh crore

12:10 pm #SE_Live_Budget Total allocation for infrastructure is Rs. 396135 crore

12:07 pm #SE_Live_Budget Proposals for electronics manufacturing received in last 2 yrs for Rs 1.26 lakh crore

12:02 pm #SE_Live_Budget Service charges for ticket booking on IRCTC withdrawn

11:59 am #SE_Live_Budget Capital Expenditure for Railways Rs 1.31 lakh crore.

11:57 am #SE_Live_Budget Budget Rail safety fund with corpus of Rs 100,000 crore will be created over a period of five years

11:48 am #SE_Live_Budget Allocation under MNREGA increased from Rs 38,500 cr to Rs 48,000 cr

11:44 am #SE_Live_Budget state-run general insurance companies are in for a bumper revenue growth next year as the Fasal Bima Yojna allocation is raised to Rs 13,240 crore next fiscal, from Rs 5,500 crore now.

11:41 am #SE_Live_Budget Dairy processing infrastructure fund to be set up under NABARD, with fund of Rs 8,000 crore.

11:40 am #SE_Live_Budget Agriculture sector expected to grow 4.6%, agriculture expenditure targeted at Rs 10 lacs crores, focus are credit agri disbursements.

11:38 am #SE_Live_Budget bring 1 crore households out of poverty by 2019.

10:40 am #SE_Live_Budget SouthEastern Analyst on wait and watch on Long Term Capital Gain Tax, its currently 1 year, we expect a 2 year window now.. above this it will be negative for market.

09:42 am #SE_Live_Budget Budget copies now in parliament. #SouthEastern has taken a preventive step to Give Intraday Trade Limit only 2 times today as Market will be Volatile due to Budget.

09:27 am #SE_Live_Budget Intraday Trade recommendation Grasim, SBI, Yes Bank, Infosys, VEDL, BOB Trade level on our tweeter side bar .

09:06 am #SE_Live_Budget Finance Minister Arun Jaitley along with officials reaches the north block, will meet the President soon. Budget start @ 11 am.

08:45 am #SE_Live_Wire

Pre Market Commentary 1st February

Today’s market heading for a flat start with the trend sideways positive. Global Setup is on Negative trend this morning, WallStreet shed over 107 point in last night trade, Asian market too trading in red while we writing here. International oil countries OPEC has achieved over 82% of pledged oil output cut in January data, which avail on SouthEasatern dash board. Indian IT firms hitting hard as Trump gets tough on H-1B visas.

Back to home, The first update which is on SouthEastern web is from ICICI Bank Q3 Result, the net profit fall’s to 19%, the NPA (bad loans) rises too in this quarter. SouthEastern putting it for short sale stock till its Q4 results out, trade strategy for Intraday:- when bank nifty break support go short on ICICI, #LongTerm portfolio :- Update the accumulation alert based on SouthEastern Stock Breakout levels. We had shared the IDEA long term trade level based on SE Equity SIP trend, it shows Rs. 70 was the Accumulation in December 2016, the stock now trading around 118.

Indian Budget, Today all eye will be on domestic big event which is Union Budget. The Economy is on bumpy ride after the Demonetisation, However the good news coming from CSO (Central Statistics Office) which said, The Economy grew by 7.9% in 2015-16, the earlier data was 7.6%. SouthEastern will share the detail budget output throughout the trade session today, our budget page is Live at www.SouthEasternpro.com , a Live chat box also avail on our website to send your queries.

SouthEastern Nifty benchmark for the day stand @ 8620, Build buy positions only if it start moving above this mark.

#SE_Live_Wire Jaitley will break away from tradition and after a period of 92 years of separate presentation of Union Budget and Railway budget, both will be presented as a combined document on an advanced date than the commonly followed schedule of end of Feb Wednesday.

Indian Budget @ 29th February 2016 - Live Updates

12:35 PM #SE_Live_Budge says there will be no change in income-tax slabs.

12:15 PM #SE_Live_Budge To introduce 1% infra cess on #petrol cars, 2.5% on #diesel cars.

11:59 AM #SE_Live_Budget Bankruptcy code to be introduced in Parliament by FY17. Rs 25000 cr allocated for Bank recap. SE- Bank recap allocation very low, dent on bank nifty expect.

11:55 AM #SE_Live_Budget Abolition of Permit-Raj in public transport system. Private players will be allowed to operate fleet services. SE Cheers @ Reforms on its way...

11:50 AM #SE_Live_Budget We Feel that So Far Till 11:50 AM, Budget is balanced and Rural India on Shine.

11:48 AM #SE_Live_Budget To allocate Rs 55,000 cr for highway projects in FY17. Total investment in road projects at Rs 2.18 lk cr in FY17, SE +Infra on Rolling

11:46 AM #SE_Live_Budget All retail shops will be allowed to operate all 7 days of the week. Retail to get boost, SE +

11:42 AM #SE_Live_Budget Govt to provide 8.33% for #EPFO contribution of new employees. SE Says Cheers on it.

11:32 AM #SE_Live_Budget Electrified 5,542 villages in FY16. To light up entire India by May 1, 2018

11:26 AM #SE_Live_Budget Rs 38,500 cr to be distributed under #MNREGA in FY17.

11:23 AM #SE_Live_Budget To incentivise gas discovery and production, Positive for RIL, ONGC etc.

11:15 AM #SE_Live_Budget Have to provide for recapitalisation of state-run banks. Increasing outlay for social sector programmes.

11:11 AM #SE_Live_Budget Govt's bold measures have helped #India to stay ahead in challenging times. Growth exceeded 7.6% despite big fall in exports.

11:07 AM #SE_Live_Budget FM Start Speech on loud note, Market reacting positive sharp up.

10:58 AM #SE_Live_Budget Should not mess with the Long Term Capital Gain Tax structure as it would be a big Disappointment, SE Top Concern ...

10:53 AM #SE_Live_Budget We are getting info that Large AUTO stock will be under pressure as Excise Duty on Diesel SUV's Expected.

10:45 AM #SE_Live_Budget Bank Nifty on Intraday Support @ 13899, We have already initiated Buy on PSU's.

10:43 AM #SE_Live_Budget Trade Call Buy SBI @ 162.25 Tgt 165.25 SL 158.30 Buy BOB @ 137.75 Tgt 140.45 SL 133.95

10:07 AM #SE_Live_Budget Govt needs to boost investment in the infrastructure sector. #NPA issue should be dealt with a step-by-step approach.

9:58 AM #SE_Live_Budget Trade Call Sell Titan @ 323.40 Tgt 31.50 SL 329.75 Buy ICICbnk @ 189.05 Tgt 192 SL 185.10

9:24 AM #SE_Live_Budget Markets are keenly watching capex and areas of deployment. Measures to solve NPA mess will impact confidence.

9:16 AM #SE_Live_Budget Net borrowing in FY17 likely at Rs 4.3-4.5 lk cr. Increased likelihood of 25 bps rate cut.