Mantra for investing

#SouthEastern Calculators

Original Size

Savings Calculator — calculate future value

This calculator easily answers the question "If I save "X" amount for "Y" months what will the value be at the end?"

The user enters the "Periodic Savings Amount" (amount saved or invested every month); the "Number of Months" and the "Annual Interest Rate" or the annual rate of return one expects to earn on their investments.

The calculator quickly creates a savings schedule and a set of charts that will help the user see the relationship between the amount invested and the return on the investment. The schedule can be copied and pasted to Excel, if desired.

The investment term is always expressed in months.

- 60 months = 5 years

- 120 months = 10 years

- 180 months = 15 years

- 240 months = 20 years

- 360 months = 30 years

If you need a more advanced "Savings Calculator" - one that lets the user solve for the starting amount, the amount to invest, the interest rate, the term required to reach a goal or the future value; or if you would like to easily print the schedule; or if you need to pick a different investment frequency, then you may want to try the calculator located here: https://AccurateCalculators.com/savings-calculator

Currency and Date Conventions

All calculators will remember your choice. You may also change it at any time.

Clicking "Save changes" will cause the calculator to reload. Your edits will be lost.

Original Size

Retirement Calculator — calculate retirement age

This calculator easily answers the question "Given the value of my current investments and assuming future monthly investments of "X", at what age will I reach my retirement goal?"

The user enters their "Current Age", the "Monthly Amount Invested",the "Annual Interest Rate (ROI)" (annualized Return on Investment one expects to earn) and "Amount Desired At Retirement".

The calculator quickly calculates the user's retirement age and creates an investment schedule plus a set of charts that will help the user see the relationship between the amount invested and the return on the investment. The schedule can be copied and pasted to Excel, if desired.

If you need a more advanced "Retirement Calculator" - one that calculates many more unknowns and one that calculates assuming retirement income and not a final lump sum then try the calculator located here: https://AccurateCalculators.com/retirement-calculator

Currency and Date Conventions

All calculators will remember your choice. You may also change it at any time.

Clicking "Save changes" will cause the calculator to reload. Your edits will be lost.

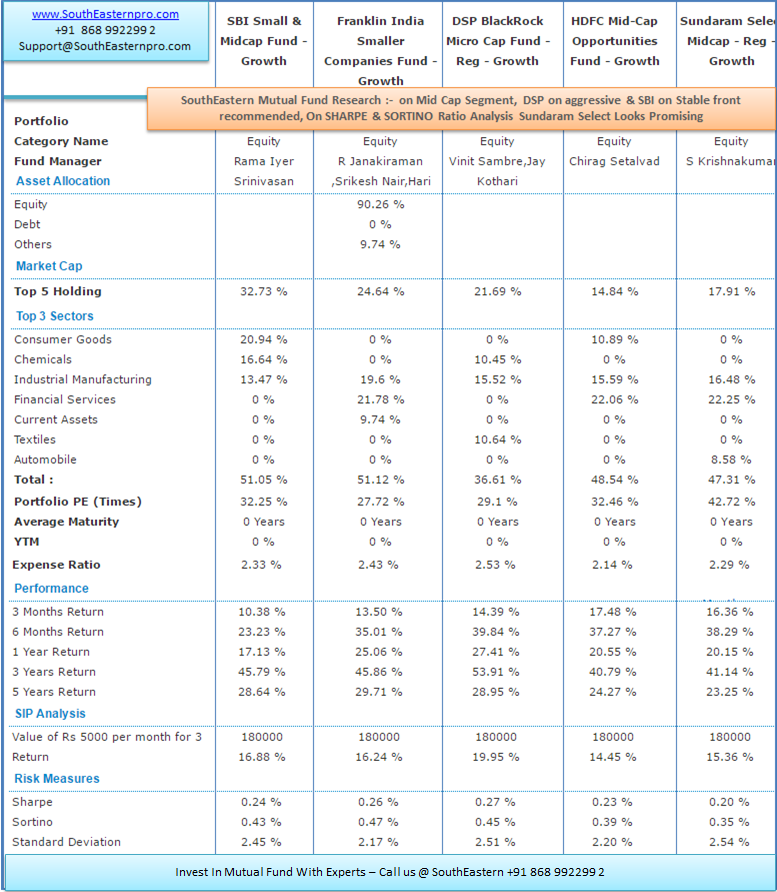

#SouthEastern - MF Strategies

Many of #SE Investor's ask, what are the best investment strategies?

At #SouthEastern we believe, investment strategies are like food diets: There is no "best investment strategy" except the one that works best for you.

Also, you don't want to implement an investment strategy and find that you want to abandon it for some hot new trend you discovered in a magazine articles. Don't get confused by all of the too-good-to-be-true flavours of the month.

at #SE we suggest stick to the time-tested basics. to use another familiar metaphor, investing styles and tactics are like the clothes that fit you best. You don't need anything expensive or tailor-made; you need something comfortable that will last a long time, especially if your investment objective is long-term (10 years or more).

So before making a commitment to anything, whether it be food diets, clothes, or investing strategies, see which works best for your personality and style. You can start by considering #SouthEastern top investing strategies, some of which are theories, styles or tactics, which can help you build a portfolio of mutual funds.

SouthEastern Fundamental Analysis Strategy

We start with fundamental analysis because it is one of the oldest and most basic forms of investing styles. Primarily used for researching and analysing equities (individual Equity stocks, rather than mutual fund selection), fundamental analysis is a form of an active investing strategy that involves analysing financial statements for the purpose of selecting quality stocks & invest.

Data from the financial statements is used to compare with past and present data of the particular business or with other businesses within the industry.

By analysing the data, the investor may arrive at a reasonable valuation (price) of the particular company's stock and determine if the stock is a good purchase or not.

#SouthEastern Value Investing Strategy

Mutual fund and ETF investors can employ the fundamental investment strategy or style by using value stock mutual funds. In simple terms, the value investor is looking for stocks selling at a "discount;" they want to find a bargain.

Rather than spending the time to search for value stocks and Analyse company financial statements, a mutual fund investor can buy index funds, Exchange Traded Funds (ETFs) or actively managed funds that hold value stocks.

#SouthEastern Technical Analysis Strategy

Technical analysis can be considered the opposite of fundamental analysis. Investors using technical analysis (technical traders) often use charts to recognize recent price patterns and current market trends for the purpose of predicting future patterns and trends.

In different words, there are particular patterns and trends that can provide the technical trader certain cues or signals, called indicators, about future market movements.

For example, some patterns are given descriptive names, such as "#SE Moving Averages", "head and shoulders" or "cup and handle." When these patters begin to take shape and are recognized, the technical trader may make investment decisions based upon the expected result of the pattern or trend.

Fundamental data, such as P/E ratio, is not considered in technical analysis where trends and patterns are prioritized over valuation measures.

#SouthEastern Buy & Hold Strategy

Buy and hold investors believe "time in the market" is a more prudent investment style than "timing the market." The strategy is applied by buying investment securities and holding them for long periods of time because the investor believes that long-term returns can be reasonable despite the volatility characteristic of short-term periods.

This strategy is in opposition to absolute market timing, which typically has an investor buying and selling over shorter periods with the intention of buying at low prices and selling at high prices.

The buy-and-hold investor will argue that holding for longer periods requires less frequent trading than other strategies. Therefore, trading costs are minimized, which will increase the overall net return of the investment portfolio.

Portfolios employing the buy and hold strategy have been called lazy portfolios because of their low-maintenance, passive nature.

#SouthEastern Value & Core Strategy

Core and Satellite is a common and time-tested investment portfolio design that consists of a "core," such as a large-cap stock index mutual fund, which represents the largest portion of the portfolio, and other types of funds—the "Value" funds—each consisting of smaller portions of the portfolio to create the whole.

The primary objective of this portfolio design is to reduce risk through diversification (putting your eggs in different baskets) while outperforming (obtaining higher returns than) a standard benchmark for performance, such as the S&P 500 Index. In summary, a Core and Satellite portfolio will hopefully achieve above-average returns with below-average risk for the investor.

#SouthEastern Archive - Knowledge series

What Is Mutual Funds ?

Mutual funds are investments that pool together the money of thousands of small investors and invest this money in stocks, bonds and/or other securities. Instead of purchasing a particular stock, you purchase shares in a whole group of stocks.

- They offer small investors access to the advantages of diversification, investing in hundreds or thousands of different companies.

- Individual stocks and bonds are risky; their value is subject to volatile investor perceptions. When you choose single stocks, you are betting on a few individual companies.

- Stock and bond mutual funds are not guaranteed − you can still lose money − but diversification minimizes some of the risk.

The Upside of Mutual Funds

- Because mutual funds are generally diversified, spreading the risk with different companies and different securities, you do not have to monitor specific stocks or other investments.

- Growth is proportionate. That is, as the fund is successful, so is your account.

The Downside of Mutual Funds

- There are hundreds of mutual funds available. You need to select wisely to avoid risking all or part of your investment.

#SouthEastern_MF_Vertical - Wishing you all a Very Happy & Prosperous New Year

While we are celebrating New year 2021 & SE_MF Part profit booking, at the same time on India's economic front it shows that the New Year start on a positive note with benchmark indices scaling all-time peaks, Nifty closed above 14000 level for the first time. The Gains across most sectors supported the markets, led by financial, automobile and IT shares.

The New year 2021 is full of hopes, #SouthEastern Mutual fund Vertical start calling the coming decade as #The_Golden_Decade. To start believing in it, just look at the top 10 development in the starting of the year 2021;

- GST Revenue collection for December 2020 recorded all time high since implementation of GST at INR 1,15,174 crore gross.

- Rollout of the COVID-19 vaccine.

- Normalization of activities and swift economic growth.

- ICRA Report said that, In the financial year 2021-22, the Indian economy is projected to register positive growth of around 10 percent, propped up by the low-base effect.

- The Centre’s fiscal deficit for April-November 2020 soared to INR 10.76 lakh crore, or 135 percent of the full year budgeted target of INR 7.96 lakh crore, as the government’s finances continued to be stretched due to lower revenues arising from the COVID-19 pandemic and the economic slowdown.

- At #SouthEastern CAD analytics shows that, India's current account surplus moderated to $15.5 billion or 2.4 percent of the GDP in the July-September quarter of the current fiscal.

- When #SE look at RBI Window it shows that India's foreign exchange reserves increased by $51.4 billion during April-September 2020 as compared with $19.1 billion during April-September 2019.

- Bank credit grew by six percent on a year-on-year basis in November compared with 7.2 percent in the corresponding period in the previous year.

- RBI has announced that it will conduct simultaneous purchase and sale of government securities under Open Market

Operations (OMO) for INR 10,000 crore each on January 7, 2021 - India Scaling up its Spending on Infrastructure, NHAI Completing various road projects in record time.

Happy Investing at #SouthEastern - #The_Golden_Decade

When we looked at the start of year 2020 at #SouthEastern it shows that the happiness & excitement of New Year 2020 had disappeared immediately as the most deadly corona virus originated from city Wuhan of China started to expand and had taken nearly 90% of world in its grip.

The worst crisis has forced the world economy under global lock-down and is disrupting supply chains, depressing consumer demand and putting millions out of work. The current global downturn is expected to be the worst since the 1930s with U.S. unemployment soaring to 33 million since the middle of March and the EU announcing it is expecting its collective GDP to shrink by 7.4 percent this year.

The Mega-stimulus from India #Atma-Nirbhar Bharat Abhiyan, relatively lesser spread of corona than other developed countries, the government also come with a mega-stimulus package. The initial stimulus package of Rs 1.7 lakh crore in March, followed by liquidity measures by the RBI and now, the stimulus package of Rs 20 lakh crore may help the Indian economy towards a vertical (V-shape) recovery. India’s Atma-nirbhar Bharat Abhiyan or Self-reliant India Mission is about 10 per cent of India’s GDP in 2019-20 and would rank behind Japan, the US, Sweden, Australia and Germany. The Indian Govt announcing big reforms which are namely opening various sectors namely Defense, Mines, ISRO space mission, Agriculture etc.

The UN has welcomed India's Covid-19 mega stimulus package, even as it slashed India’s growth rate for this fiscal year to 1.2 per cent. By this mega-stimulus package, the Indian government has tried to balance between supply side of the economy and demand constraints.

The IMF’s April projection for a 3% contraction the global economy would mark the steepest downturn since the Great Depression of the 1930s. IMF also warned that outcomes could be far worse, depending on the course of the pandemic. The growing steps of stimulus Global responses to combat with corona virus and to pull back the corona hit economy on track of growth are quite different compared to economic size.

The Central banks and governments have unveiled an estimated $15 trillion of stimulus already to shield their economies from the corona virus pandemic. The sum equates to about 17% of an $87 trillion global economy last year. Central banks will also buy more bonds; with some saying there is no cap on purchases. U.S. has committed to the largest rescue package of any country in pure dollar terms over three congressional stimulus phases ($8.3 billion, $192 billion and $2.5 trillion). But in term of percentage, the U.S. measures are estimated 13 percent of GDP and it is actually trails Japan's measures which equate to just over 21 percent of GDP. It has outlined USD 1.1 trillion recovery package and plans for further spending.

In Europe where Spain and Italy have endured devastating corona virus outbreaks, the size of stimulus packages are estimated to be 7.3 percent and 5.7 percent of GDP respectively. Germany has announced a spending of around USD 815 billion, equal to 10.7 per cent of its GDP. Italy has announced an Euro 750 billion (around USD 815 billion) package.

At SouthEastern we are looking the pace and strength of the recovery from the current crisis not only hinges on the efficacy of public health measures in slowing the spread of the virus, but also on the ability of countries to protect jobs and incomes, particularly of the most vulnerable members of our societies.

When Warren Buffet Said "Not to Put All of Your Eggs in One Basket" what it mean in practical investment:

When Warren Buffet Said "Not to Put All of Your Eggs in One Basket" what it mean in practical investment:

- It is very hard to predict what investments will do best in any given year. You need to save your money in different investments so that you are taking advantage of the earning power of higher return investments, while also protecting some of your money in less risky investments.

- Stocks have historically had the strongest record of high returns over the long term.

- In some individual years, however, bonds have the best returns.

- Cash investments usually provide the lowest return, but they also come with the least amount of risk of losing value.

@ SouthEastern we share Investment Information in a very simple format which is easy to understand, Now Learn how to invest wisely in Govt Securities, Bonds, Fixed Deposits, Recurring deposits, Mutual Funds, Gold, Equity and other investment vehicles. Here re some basic information to get your started:

When I speak with our investors @ SE forum about Investment, they are not able to find the proper way out on Asset Allocation, Risk Analysis, Long & Short term duration of investment etc, after this topic you will get basic Idea on this terms.

What is Asset Allocation?

@ SouthEastern Asset allocation simply means that you decide how you will invest your savings among the stocks, bonds, Real Estate, Govt Securities and cash.

For example, if you are going to invest Rs. 100 and you have decided that you want to have:

15% in Cash, 25% in Govt Securities, and 60% in Stocks

You would put:

Rs 15 in Cash, Rs 25 in (FD's, bond etc), and Rs 60 in Stocks.

Each time you invest, you would split up your money in the same way.

How Much Should I Put in Each Type of Investment?

@ SouthEastern we often give different examples or formulas, depending on a number of different circumstances, including how much risk you want to take and how soon you will need the money.

Rule of thumb: If you are saving toward a goal that is:

- 1-3 years away, put more into cash investments.

- 3-10 years away, put your money into a mix of cash, stocks and bonds,

- 10 years or more, invest primarily in stocks.

@ SouthEastern we suggest an easy formula in which you subtract your age from 100 and invest at least that percentage in stocks. For example, if you are 45, you would put at least 55% into stock funds (100-45=55). Others suggest that is too low, especially if you are saving primarily for retirement, which would still be 20 years away. There is no perfect answer, but don't let that stop you from investing. Do the best you can, and get help from Experts in the field.

Other Example Allocations:

Conservative: 20% in Cash; 40% in Bonds; 40% in Stocks

Moderate: 10-25% in Cash; 25-30% in Bonds; 50-65% in Stocks

Aggressive: 5% in Cash; 15% in Bonds; 80% in Stocks

There are three basic places where you can invest your money:

1. Cash - includes certificates of deposit (CDs) and money market funds; cash does not earn enough interest to keep its value due to inflation

2. Govt Securities (G-Sec Bonds) - a certificate of debt from a company or government; includes Treasury bills, and mutual funds can also include /or government bonds

3. STOCKS - a share in a company; mutual funds can include stocks known as large-caps, mid-caps or small-caps that represent the size of large, middle-sized or small companies

3rd February 2018 I SouthEastern Mutual Fund Alert I LTCG Implementation & Budget Impact -

We had already shared a detail analysis on Indian Budget and its impact on Economy. A Dedicated Budget page already there on our website to further analyze the outcome. However, our worst fear has now come true which is LTCG (Long term capital gain), yes govt has given its nod to implement it.

We are expecting a a down fall from current level of sensex 35066. We have put #SouthEastern analytics support for BSE Sensex @32389. if BSE sensex break this mark, we need to follow the following exercise on MF Portfolio investment.

- The Clients who started investing from March 2014 onward, should book 40-50% of profit at this level and move it to Liquid funds where equity exposure nil and will get stable return 6-7%. also increase SIP amount by10% to accumilate more units on lower NAV's.

- The clients who completed 2 FY's should book 20%, move profit to Liquid funds.

- The clients who started investing from from January 2017 or about to start, this is a good time as market will go down and you will get Units on Lower NAV's. as we always suggest we need to be greedy when market fall & fearful when it high.

Sector Funds; we are currently holding 2 Sector funds for our clients, Infra & FMCG. (Banking re-entry pending on FDI limit final approvals). We are ok to aggressive profit booking, since infra & FMCG generated over 45% return from entry-level. No harm to book profit, once we see market stabilize we need to route this profit back on lower level.

24th March 2018 - Extended Update

#SouthEastern Mutual Fund Vertical - Trend Update

We have got many queries about recent fall in Markets and what will be the trend going forward..

1. on 2nd February 2018, when Indian Budget was disappointed one & LTCG announced, we had guide our clients (3+ years portfolio) to book 40% profit and move it to Liquid fund.. at that time BSE sensex was at 35066. (Refer image)

Today BSE sensex 32596, it's almost corrected 2500 points from our profit booking level, we gave proper exit call to our clients.

2. The important thing how market will react from now;

We are looking Nifty Strong support at 9800 mark in April, if any global negative news comes then next support will be 9300.

After April we are expecting a rally in market till 2019 election, the rally will be more strong and it could break the Nifty all time high again, it means a 2000 point rally till 2019 expected.

The guidance will remain same, continue with SIP's wait for a breakout to move profit back to equity funds.

Our sector fund sbi FMCG fund which Recommended in 2016 today top rated #1 position in equity category with 52.48% annual return, check on our web page or AMFI site "SBI FMCG fund" #SE recommended sector funds perform well and consistent even if market fall Kindly feel free to call me, if you have any more queries on your MF Investment...

Happy Investing...

24th June 2016 I @ SouthEastern Mutual Fund Vertical

Britain has voted to leave the European Union, SouthEastern has analysing its Impact on our MF Clients Portfolio, it shows that this will lead to a period of uncertainty, risk assets across the world are witnessing selling pressure which could intensify going forward.

We are likely to be in a period of heightened volatility, investors should take advantage of it rather than getting swayed by it.

When I look at the overall Global scenario and the Impact on India, It gives me a positive approach based on the below finding in SouthEastern Analytics;

- Indian GDP has nearly 65-70% domestic consumption, It shows we are primarily a domestic focused & demand led Economy.

- The fall in Crude is surely on card from now, Fall in commodity lead to large savings in import bill (every $1 drop in crude prices leads to roughly $ 1 billion savings in India’s oil import bill). This would reduce India’s trade & current account deficit (CAD) and counter any negative impact due to foreign capital outflow that may happen as part of movement towards safe haven assets.

- Lower commodity prices would dampen ‘imported’ inflation and help the RBI in pursuance of its stance of monetary accommodation.

- Record forex reserves. Fiscally prudent government, large FDI inflows to cushion India’s external economy

- With record foreign exchange reserves of $ 340 billion & expected forex outflows in September 2016 on the FCNR (B) front already covered, RBI is likely to intervene to stamp out any unusual volatility in the currency markets. India emerged as the recipient of the highest FDI inflows in 2015 surpassing China & US due to open door policy pursued by the Indian government by increasing the caps on foreign holdings in many crucial sectors & improving measures of ease of doing business. Government’s adherence to fiscal discipline & narrowing CAD would allay any apprehension in the bond markets which otherwise would betray a sense of nervousness due to likely FII outflows especially on the debt side.

- Apprehensions of immediate rate increases in the US buried for now, It would also allay fears of any immediate rate increase by the US Fed which would see a rising dollar (and falling currencies of its trade partners like Euro, Pound etc) as well as falling commodity prices as strong headwinds to US economic growth.

While compiling all the above facts, SouthEastern analysis suggest that investors need to take a measured approach and not get carried away by doomsday scenario in so far impact on Indian economy & markets are concerned. Once the dust settles down, India will be seen to be a net gainer and inflows would continue to gravitate towards Indian shores.

On a relative basis, India's macro fundamentals have improved with continuing reforms, record level of Forex reserves, contained fiscal and current account deficit and inflation under check. Private consumption has been showing signs of improvement. Better monsoon, government spending and VII pay commission should help in sustaining the growth momentum.

Our focus in equity funds continues where to be on bottom up stock picking will be a key factor, @SE we are now focusing more on the MF Portfolios where the Stock related with the Rural and Domestic Revenue weightage more. We are suggesting to increasing the SIP on Rural sector fund, as the Current Indian budget theme is based on that.

@SE when we elaborate our analysis on Brexit it shows that market participants have been discussing about it but actually the risk wasn't priced in adequately. Brexit is not a one-off event but may have far reaching implications. Anti-EU voices in other parts of Europe will gain strength. Anti-globalisation voices (like Donald Trump) will gain strength.

British economy will face challenges; Pound Sterling has witnessed severe beating today. From India's perspective, companies having direct exposure to Britain will get adversely impacted. If Risk-off trend continues then there could be further outflows from emerging markets like India impacting rupee and equity markets.

But we have to remain vigilant as there are strains in corporate and banking sector balance sheet. We can't be completely insulated from what's happening in rest of the world. Global economy continues to face challenges and Brexit has added another dimension of risk. Rupee is likely to remain under pressure as U.S. dollar gains on safe-haven demand. While there could be some outflows from FIIs in Indian bonds; in a global risk-off environment, bond yields are likely to soften.

#SouthEastern View on Current market correction with its detail analysis on global and Domestic Concerns :- Review Date :- 21st December 2016

India's fast-growing economy may be a ray of hope among struggling emerging countries, but that hasn't helped stocks there escape the global market selloff this year.

The country's benchmark S&P BSE Sensex index could be the next to enter bear territory following markets in Shanghai and Tokyo, having fallen 17% since its most recent peak a year ago. That is despite expectations India will grow by around 7.4% in the year to the end of March, faster than other major developing countries like China and Brazil. A bear market is defined as a drop of at least 20% from a recent peak.

For some, the sagging of Indian stocks marks the end of the so-called Modi wave--the nearly 30% surge in shares in 2014 when Prime Minister Narendra Modi was elected on a promise of making it easier to do business in India. Mr. Modi's reform efforts have become bogged down since, while Indian corporate earnings have shown little improvement.

But India's stock market also is suffering from its high reliance on foreign investors, who own $285 billion-worth of the country's listed shares, as per the data suggest on SouthEastern analytic, Domestic institutional investors own only around $60 billion worth of shares, by contrast.

Up until October last year, global investors had poured $4.7 billion into Indian stocks in 2015, according to regulatory data. Since November, however, such investors have withdrawn $3 billion, part of a broader pullback from emerging markets since investors became certain the U.S. Federal reserve would start raising interest rates. Foreign investors have yanked $1 billion out of Indian stocks this month alone, according to the data.

As per SouthEastern OPEC analysis much of the selling has come from sovereign-wealth funds based in the Middle East and other regions that earn income from oil. As crude oil prices have fallen, the budgets of these governments have shrunk, and they are dipping into the assets of their wealth funds to meet their spending needs.

"They are not selling because India is a bad market, but they need money, The fall in global oil prices has had a more direct effect on some of India's biggest listed companies. Shares in state-owned Oil and Natural Gas Corp., one of India's biggest oil explorers, have fallen 37% over the past year.

Meanwhile, China's slowing growth is also harming Indian stocks, albeit indirectly. As China manufactures less, the prices of metals such as steel and copper are falling. That, in turn, is lowering Indian mining companies' revenue.

Analysts fear that Indian banks, which lent heavily to these companies, may not get their money back. Half of the Sensex index comprises commodities and banking stocks.

For sure, some of India's problems are homemade. Investors had hoped the Modi government would quickly increase investment in infrastructure, which would create jobs and raise incomes , boosting consumption. Although the government has made moves to build more roads, the results aren't yet visible. Poor monsoon rains last year hurt crop production and rural wages, further tempering demand.

"This government underestimated the complexity of the challenges that they inherited, and overestimated their ability to deliver,"

Meanwhile, major legislation, such as a bill to allow the introduction of a new national goods-and-services tax, has faced resistance in Parliament. Analysts estimate such a uniform national tax could boost India's gross domestic product by up to 2% by reducing red tape .

"The initial hope was everything will happen very fast. But it's not happening at that pace,""The big promises and big slogans are not yet executed.

Expectations that interest-rate cuts by India's central bank would encourage companies to borrow and invest haven't been realized. Although the Reserve Bank of India has cut its benchmark interest rate by 1.25 percentage points since Jan. 2015, banks have passed on only half of that onto clients.

Majority of money managers remain hopeful that India can still do well.

@ SouthEastern We are expecting profits for Indian companies and consumption to pick up, partly as the government raises wages of 34 million employees as part of its periodic review of salaries. "At the end of the year, the broader market returns will be decided by earnings in India.

Tweet your feedback #SE_LIVE_WIRE

*Chart linked to server, Refresh if out put not appear