@ SouthEastern plan your Taxes Efficiently

Tax Planning is very important aspect on your over all financial planning; most of us look for tax-saving investments in order to reduce our tax outgo. Last minute urgencies often lead us to buying something that might save tax, but end up being inappropriate when taking into account our financial profile and goals. For example, a young individual may hastily invest in tax-saving fixed deposits (FDs) when he should actually be looking to invest in growth options such as equity linked savings schemes (ELSS). It is important that all our investments, including tax-saving ones, are linked to our financial profile and goals. Here we look at how proper planning can help serve the twin objectives of saving taxes and meeting goals.

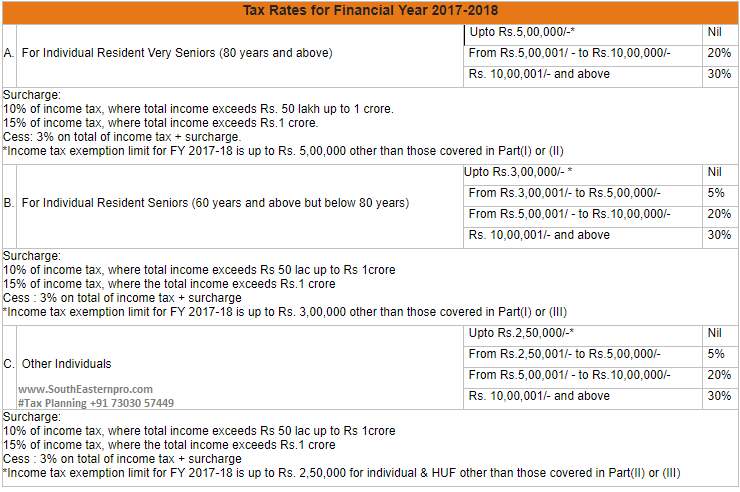

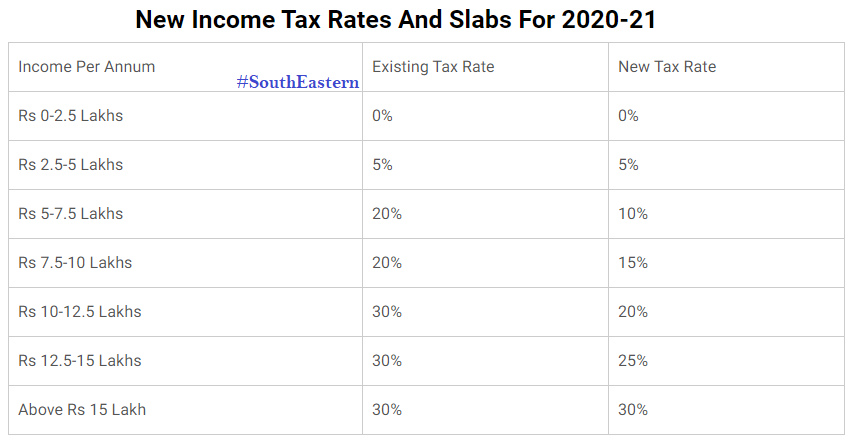

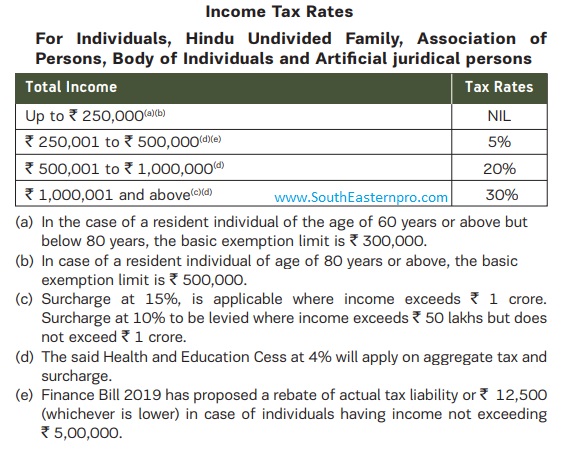

Tax slab's applicable for the financial year 2020-21 (based on latest budget inputs)

Available Deductions under Various Sections

You can avail the following deductions from the taxable income and save taxes:

|

Section |

Limit | Investment Avenues |

Eligibility / Conditions |

| 80C* | Rs. 1,50,000 | Life Insurance Premium, EPF/VPF, PPF, NSCs, ULIP, ELSS, Approved Superannuation Fund, Tuition Fees of any two children, Tax Saving Bank FDs with lock-in period of minimum of 5 years, Repayment of principal amount of housing loan, Sukanya Samriddhi account | |

| 80CCC* | Rs. 1,50,000 | Contribution to approved Pension Funds | |

| 80CCD*@ | 10% of salary or 10% of gross total income (for non-salaried) | Contribution to Pension Scheme by Central Government | |

| 80CCG | 50% of investment subject to maximum of Rs. 25,000 | Subscription to Equity Share / MF Units for new Investors- Rajiv Gandhi Equity Savings Scheme (RGESS) | Gross Total Income not exceeding Rs. 12 lakh Assessee is a new investor Lock-in Period for investment is of 3 years Investment to be made in specified equity shares / MF Units |

| 80D | Rs. 25,000 | Mediclaim | Individual / HUF |

| Rs. 25,000 | Mediclaim towards health of parents who are not senior citizen | ||

| Rs. 30,000 | Mediclaim towards health of parents who are senior citizen | ||

| Rs. 5,000 | Preventive Health Check-up | ||

| Rs. 30,000 | Medical Expenditure incurred on oneself or his / her parents. This clause is applicable only for very senior citizens (80 years or above). | Provided, there is no medical insurance in force for such persons | |

| 80DD | Rs. 75,000 | Expenditure incurred on medical treatment / training / rehabilitation of a dependent with disability or amount deposited in designated scheme of LIC / other Insurers | A copy of certificate issued by medical authority in prescribed form required |

| Rs. 1,25,000 | Expenditure incurred on medical treatment / training / rehabilitation of a dependent with severe disability or amount deposited in designated scheme of LIC / other Insurers | A copy of certificate issued by medical authority in prescribed form required | |

| 80DDB | Rs. 60,000 | Amount actually paid for medical treatment of specified disease or ailment for other than senior citizens | A copy of certificate issued by medical authority in prescribed form (Form No.: 10-I) required |

| Rs. 80,000 | Amount actually paid for medical treatment of specified disease or ailment for senior citizens | A copy of certificate issued by medical authority in prescribed form (Form No.: 10-I) required | |

| 80E | 100% of interest paid | Interest on educational loan Deduction is allowable in the initial year and upto subsequent 7 consecutive years |

Loan availed by either Individual or his / her relative |

| 80G | 100% or 50% (subject to 10% of gross income in certain cases) |

Donation to certain funds, charitable institutions | |

| 80GG | 25% of total income or Rs. 2,000/- pm whichever is less | Rent paid | The individual / spouse / minor child / HUF does not own any residential property Rent paid is in excess of 10% of his total income |

| 80GGA | Entire amount | Payment to a research association / fund as notified by government | Individual |

| 80GGC | Entire amount | Contribution given to political parties other than by cash | |

| 80TTA | Rs. 10,000 | Interest on savings bank (SB) Account | SB Account maintained with any Bank (commercial or co-operative), Post Office |

| 80U | Rs. 75,000 | A Person with disability | A copy of certificate issued by medical authority in prescribed form required |

| Rs. 1,25,000 | A Person with severe disability | A copy of certificate issued by medical authority in prescribed form required |

*The combined limit for deduction under Section 80C, 80CCC and 80CCD@ is restricted to Rs. 1,50,000.

@ Additional deduction under section 80CCD(1B) restricted to Rs. 50,000.

# The overall limit for deduction under section 80D is limited to the extent of Rs. 30,000.

A few changes in taxation this year worth taking note:

Mediclaim gets more tax benefit: Medical premium deduction under section 80D has been increased from Rs. 15,000 to Rs. 25,000. For senior citizens, it has increased from Rs. 20,000 to Rs. 30,000. For very senior citizens, whose medical insurance is not possible, deduction up to Rs. 30,000 is now allowed on medical expenses incurred. Sukanya Samriddhi Account introduced u/s 80C: Sukanya Samriddhi Account offers a small deposit investment for the girl children as an initiative under ‘Beti Bachao Beti Padhao’ campaign. Investment up to Rs. 1,50,000 in this account is tax eligible for deduction u/s 80C. Any interest received is also tax-free. The current interest rate is 9.2% p.a. Minimum deposit of Rs. 1,000 and maximum of Rs. 1,50,000 can be made in a financial year. There is no limit on number of deposits either in a month or in a financial year. Deposits in an account may be made till completion of 14 fourteen years, from the date of opening of the account. A legal Guardian/Natural Guardian can open account in the name of Girl Child, till she attains the age of ten years. Note: it can be opened for two girl children only. The maturity of account is 21 years from the date of opening of the account or marriage of the girl child, whichever is earlier. For marriage, girl should be of 18 years. The operation of account is not permitted beyond date of marriage. One premature withdrawal is allowed on attaining the age of 18 years by girl child only if funds are required for higher education and marriage -- up to 50% of the balance at the credit, at the end of preceding financial year. Additional deduction of Rs. 50,000 for NPS: The union budget 2015 announced a slew of measures w.r.t. to National Pension System (NPS). First, it has allowed an extra tax deduction of Rs. 50,000 for contribution made towards NPS, under Section 80CCD (1B), which is over and above the deduction available under section 80C. Second, it increased the limit of contribution to pension plans, including NPS, from Rs.1 lakh to Rs.1.50 lakh under section 80CCE(1). This comes to a total of Rs.2 lakh deduction available for NPS. With this, a contribution of Rs.2 lakh would result into a tax saving of Rs.20,600, Rs.41,200 and Rs.61,800 for individuals in 10.3%, 20.6% and 30.9% tax brackets, respectively. On the other hand, if you are investing only Rs.50,000 for getting the additional tax benefit under section 80CCD (1B), it will help you save Rs. 5,150, Rs.10,300 and Rs.15,450 for the tax brackets 10.3%, 20.6% and 30.9%, respectively. NPS as an investment option not only helps you provide lump sum, but also regular income post retirement since it requires annuitizing the accumulated corpus. Say for example, if you invest Rs. 15,000 per month into NPS for the next 30 years, you will be able to create a total pension wealth of Rs. 5.24 crore (at 12% p.a. return), from which you can withdraw Rs. 3.14 crore on maturity (60%) and get a pension of Rs. 1.22 lakh per month (from buying annuities).

Tax-saving investments: Align with your financial goals

Investing just to save tax is an ad hoc manner of financial planning. All your investments, including tax-saving ones, must be aligned to your long-term financial goals. Some of your financial goals are: Having an adequate life and health insurance, owning a house, children’s education and marriage, retirement planning, etc. Let’s take a look at the financial goals and the appropriate tax-saving instruments that will help in achieving those goals.

Life insurance: Having an adequate life cover is fundamental to a sound financial plan. It ensures that your family will be able to meet goals and obligations in case of an untoward event. The cover should be sufficient enough to take care of: a) Family expenses till lifetime; b) Liabilities outstanding and c) Family & children goals.

The best way to provide protection is through pure term plan – it gives high coverage at low cost. For example, a Rs. 1 crore term cover for a 30-year-old costs just around Rs 10,000 per annum. With the help of life insurance, you will be able to not only protect the financial needs of your family, but also save taxes under Section 80C.

Health insurance: Given the rising healthcare costs, sudden or serious illness can set one back for years. The cost of key surgeries and medical procedures in many private hospitals is higher than the annual household income of between 60% and 90% of India’s population, according to a report by audit and consulting firm EY. The report estimates average cost of tertiary care procedures including bypass surgery, angioplasty, neurosurgery, oncology radiation and surgery, and renal and liver transplants in the range of Rs.2,00,000 to Rs.4,00,000, which is more than the annual average household income of all Indians. India’s average household income was Rs.1,57,683 in 2012-13, according to a March 2014 CMIE report.

Health insurance protects you from unexpected, high medical costs. Still, majority of Indians are largely uninsured or underinsured. The EY study says that just about 300 million people in India have some form of health insurance. According to WHO, 70% of Indians continue to pay for medical expenses out of the pocket, in comparison to just 30-40% in other Asian countries.

The importance of health insurance being an integral part of your financial plan can only be overstressed. Make sure you have an adequate health insurance throughout life stages. A family of 2 adults and 2 children can get a Rs 4 lakh cover for just around Rs 15,000 per annum. You can also avail tax benefits of up to Rs. 30,000 under Section 80D.

Buying a house: A home loan is the most common source for fulfilling the goal of buying a house. Tax benefits can also be claimed on both the principal and interest components of the home loan. You can avail deduction up to Rs 1.5 lakh per financial year towards principal repayment on home loan under Section 80C. Stamp duty and registration charges are also eligible for deduction under Section 80C. Tax benefit on these can be availed only in the year you make the payment.

For interest payments, you can avail deduction up to Rs 2 lakh per financial year under Section 24. This is for a self-occupied house. However, for the let out property/ properties, there is no such cap. The entire interest paid can be deducted from the income from House Property (Section 23). You can choose any one property as self-occupied. Remaining will be automatically considered as let out property.

Note, you and your spouse (being tax-payers with independent sources of income) can get separate tax deduction benefits with respect to the same home loan. However, it is important that the house and loan is in your joint names.

Children’s education: The cost of education in India is rapidly increasing, including school expenses. For example, school expenses of a single child including tuition fees have risen from Rs. 55,000 in 2005 to Rs.1,25,000 per annum in 2015, reveals a survey by ASSOCHAM. While the annual fees are on average Rs. 65,000 to Rs. 1,25,000 on single child for regular schools, even the pre- schools for those aged 3 to 5 cost, parents about Rs. 35,000 to Rs. 75,000 a term. Over 70% of parents spend 30-40 per cent of take-home pay on their children education, placing significant burden on their family budget, it adds.

One must start investing early for children’s education goal to give it enough time to grow. Initially, the allocation must be higher towards equities and later, start shifting towards fixed income to reduce the risk. Depending on the time horizon for the goal, you may invest in ELSS, ULIPs, PPF, NSCs, etc. For example: If your child is just 3 years of age and there is about 15 years remaining for her higher studies, investing in an ELSS could be a prudent option. If your child’s education goal is just 5-6 years away, investing in bank deposits or NSCs could be better option. All these investments - ELSS, PPF, ULIPs, NSCs, bank FDs - are deductible under Section 80C.

Retirement planning: The face of retirement is changing. Today, most of us can’t count on what our previous generations could, for their retirement needs. Assured pension, guaranteed returns from government schemes, support from a joint family, and periods of relatively low inflation -- are almost things of the past. Our retirement is going to be very different from that of our parents or grandparents. We would need to fend for ourselves for our retirement needs. Factors such as increasing life spans, rising inflation, preference for nuclear families, absence of pension systems, etc. necessitate early investing for retirement. The earlier you start the greater you can save to create a nest egg for old age. There are various financial products that will not only help you reach your retirement goals but also save taxes in the process.

There are basically two phases for retirement planning - Accumulation phase (accumulating/building the adequate retirement corpus) and Distribution phase (withdrawing from your retirement corpus for regular income). Growth-oriented options such as ELSS, ULIP, NPS etc could be looked upon for accumulation phase / building the retirement corpus. For distribution phase, options such as bank deposits, NSC, SCSS, etc could do well. Investments in all these instruments are deductible under Section 80C subject to a maximum of Rs 1.5 lakh.

Make a judicious choice

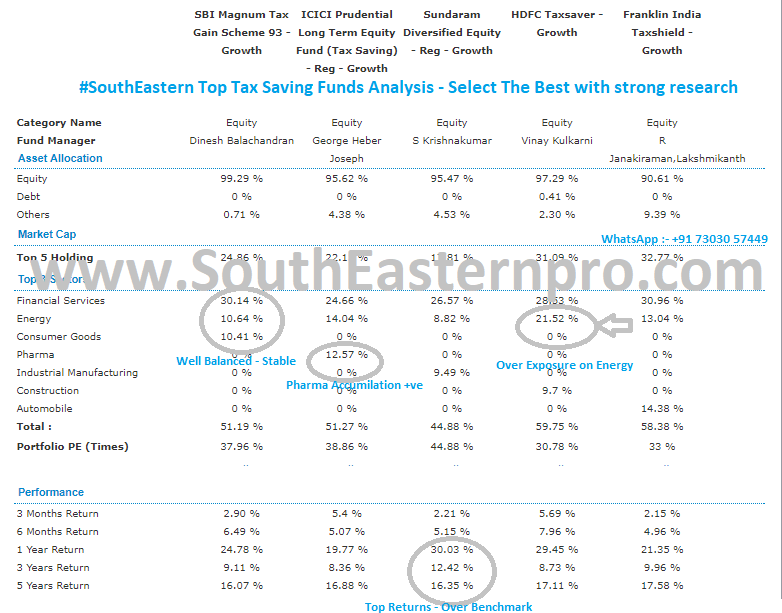

You have a wide array of choice of products under section 80C - ranging from term insurance to endowments to ELSS schemes to government sponsored schemes like NSC and post office savings. SouthEastern Financial Team has compiled & Compared the various options to help you pick the right mix.

| Investment Option | Brief | Minimum Investment | Maximum Investment | Lock-in Period | Risk/reward potential | Returns/ Indicative Returns | Inflation-protection level |

| Equity Linked Savings Scheme (ELSS) | Tax-saving, equity diversified mutual funds | Rs. 500 | No limit, but deduction available up to Rs. 1.5 lakh | 3 years | High | 12%-15% | High |

| Unit Linked Insurance Plan (ULIP) | Insurance-cum-investment plan | Rs. 10,000 | No limit, but deduction available up to Rs. 1.5 lakh | 5 years | Medium/High | 8%-12% | Medium/High |

| Public Provident Fund (PPF) | Government-backed savings-cum-tax-benefit debt instrument | Rs. 500 | Rs. 1.5 lakh | 15 years; partial withdrawals available from the sixth year | Low | Current rate: 8.7% | Low |

| Employees' Provident Fund (EPF) | Debt-oriented savings-cum-tax-saving instrument | If your basic salary + DA is below Rs. 15,000: 12% of the actual basic salary + DA

If its above Rs. 15,000, then 12% of Rs. 15,000 |

12% of actual basic salary + DA | Till retirement, but partial withdrawals available after 5 years in special circumstances | Low | Current rate: 8.7% | Low |

| Voluntary Provident Fund (VPF) | Debt-oriented savings-cum-tax-saving instrument | Depends on your employer | Up to 100% of basic in VPF, but overall deduction available up to Rs. 1.5 lakh | Till retirement, but partial withdrawals available after 5 years in special circumstances | Low | Current rate: 8.7% | Low |

| National Pension System (NPS) | A defined-contribution based pension product by the government of India | Rs. 500 p.m./ Rs.6,000 p.a. | No limit, but total deduction available up to Rs. 2 lakh | Till 60 years of age; can withdraw up to 60% of corpus when you reach 60 | Medium - depends on asset class you choose to invest in | 9%-15% | Low to medium - depends on asset class |

| Pension plans / Schemes | Retirement products - for creating pension corpus and regular income | Rs. 10,000 | No limit, but deduction available up to Rs. 1.5 lakh | Usually till your retirement age | Medium/High | 8%-12% | Medium/High |

| Senior Citizen Savings Scheme (SCSS) | Senior citizens-oriented small savings scheme | Rs. 1,000 | Rs. 15 lakh, but deduction available up to Rs. 1.5 lakh | 5 years | Low | Current rate: 9.3% | Low |

| National Savings Certificates (NSCs) | Govt-backed fixed income investment | Rs. 100 | No limit, but deduction available up to Rs. 1.5 lakh | 5 years (NSC VIII Issue) / 10 years (NSC IX Issue) | Low | 8.50% for NSC VIII Issue

8.80% for NSC IX Issue |

Low |

| Tax-saving fixed deposits (FDs) | A special category of FDs with tax-saving benefit | Varies from bank to bank. Rs.100-Rs. 10,000 | Rs. 1.5 lakh | 5 years; Premature withdrawal not available | Low | 6.75% – 9% | Low |

| Sukanya Samriddhi Account | Small savings scheme for girl children | Rs. 1,000 | Rs. 1.5 lakh | 21 years; Partial withdrawal up to 50% available after girl attains 18 years of age | Low/Medium | Current rate: 9.2% | Low |

Summing up

The tax-saving instruments are the very investments that one anyway makes and therefore they need to be integrated into the larger picture in line with your risk profile and financial goals. The tax saving is just the icing on the cake. In other words, while tax deduction is an important aspect to look at, it is more essential to consider what you would achieve out of that investment. @ SouthEastern the purpose of the investment is more important than the investment itself.

To start with, let’s go through the current tax slabs and available deductions under various sections.